Practical Guide to the EB5 Visa for UK Investors

Wiki Article

Unlocking Opportunities: The Complete Guide to EB5 Visa for UK Citizens

The EB5 visa program supplies a pathway for UK residents looking for permanent residency in the USA with investment. Comprehending the eligibility standards and financial investment needs is crucial for prospective candidates. This guide provides a comprehensive overview, consisting of understandings on regional centers versus straight investments. As investors browse this complex process, they have to also think about the task creation requirements and the advantages that go along with the EB5 visa. What factors will eventually influence their choice?Comprehending the EB5 Visa Program

While several immigration options exist for individuals looking for to transfer to the USA, the EB5 Visa Program attracts attention as a distinct path for capitalists. Made to promote the U.S. economic climate, this program enables international nationals to get permanent residency by investing a minimum of $1 million, or $500,000 in targeted work areas. Capitalists have to create or protect a minimum of 10 full time work for U.S. employees through their investment in a new commercial venture. The EB5 Visa not only offers a course to united state citizenship yet likewise offers capitalists the opportunity to take part in numerous business endeavors. This program allures specifically to those looking to expand their possessions while contributing to the economic development of the USA.Eligibility Standards for UK Citizens

The Investment Process Explained

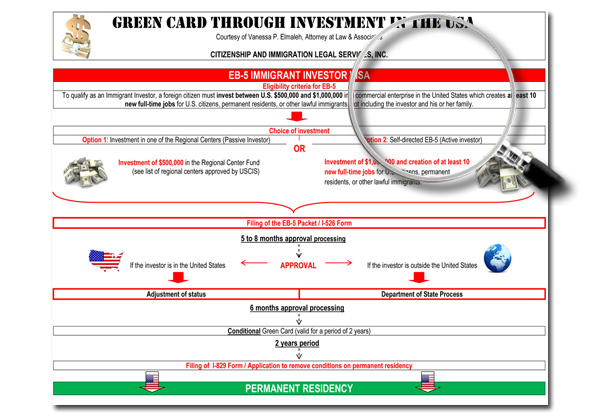

Guiding the financial investment process for the EB5 Visa includes a number of vital actions that should be meticulously complied with to guarantee compliance with U.S. migration legislations. Capitalists should pick between straight financial investment or participation in a marked local. Next off, they need to prepare the necessary documentation, consisting of proof of funds' validity and a detailed service strategy that shows how the financial investment will create the required work. After choosing an appropriate investment opportunity, the investor needs to transfer the resources, which is commonly a minimum of $1 million, or $500,000 in targeted work locations (Investor Visa). Lastly, filing Kind I-526 with the United State Citizenship and Migration Services is necessary to launch the application procedure and protect the capacity for long-term residencyRegional Centers vs. Direct Investment

When considering the EB5 visa, UK residents deal with a choice between investing via local centers or selecting straight investment. Each option includes distinctive investment frameworks, varying work development demands, and varying degrees of threat assessment. Recognizing these distinctions is important for making an informed choice that straightens with private investment goals.

Financial Investment Framework Differences

While both Regional Centers and Direct Investment stand for paths for obtaining an EB5 visa, they differ considerably in structure and demands. Regional Centers are companies designated by the USA Citizenship and Migration Solutions (USCIS) that swimming pool financial investments from numerous financiers right into bigger jobs. This structure allows for a more varied threat and often involves much less straight administration from the financier. Conversely, Direct Investment calls for a capitalist to position their funds into a details business and take an active duty in its management. This straight method often demands even more hands-on involvement and an extensive understanding of business landscape. Each option provides one-of-a-kind difficulties and benefits, influencing the financier's decision based upon personal choices and financial investment objectives.Job Development Needs

Job production needs are a vital element of the EB5 visa process, varying considerably in between Regional Centers and Direct Financial investment options. Regional Centers concentrate on task development indirectly, enabling investors to count jobs created with economic activity boosted by their investments. A minimum of 10 tasks have to be created or protected per investor, usually achieved through larger, pooled investments in projects like property developments. On The Other Hand, Direct Financial investment mandates that capitalists directly create at the very least 10 full time work within their own organizations. This approach may need much more active management and oversight by the investor. Recognizing these distinctions is crucial for potential EB5 candidates, as the selected course greatly impacts their capacity to satisfy the program's task production requirements.Threat Evaluation Considerations

Just how do risk aspects differ between Regional Centers and Direct Investment alternatives in the EB5 visa program? Regional Centers typically supply a varied investment technique, merging funds from several financiers into bigger tasks, which can mitigate specific risk. The success of these facilities counts on their monitoring and task option, presenting potential risks if improperly handled. Conversely, Direct Financial investment permits capitalists to maintain higher control over their funds by spending straight in a business. While this option may supply a more clear understanding of financial investment operations, it additionally carries greater threats due to the specific organization's efficiency and market volatility. Eventually, investors should weigh the advantages of control versus the integral threats of direct involvement versus the collective safety of Regional Centers.Job Development Requirements

A crucial aspect of the EB5 visa program includes conference specific job production demands, which are necessary for ensuring the effective combination of foreign financiers right into the united state economic situation. To qualify, an EB5 investor need to maintain or create at the very least ten permanent work for united state workers within 2 years of their investment. These work have to be straight, meaning they are created straight by the business in which the financier has spent. Conversely, if spending in a targeted work location (TEA), the investor may additionally be eligible through indirect work creation, which is computed based upon financial impact. Fulfilling these work development needs not only benefits the capitalist but additionally contributes positively to local areas and the total united state workforce.Benefits of the EB5 Visa

The EB5 visa program offers numerous benefits for capitalists looking for a pathway to permanent residency in the United States. Among the key advantages is the chance to obtain visa for the financier, their spouse, and single children under 21. This visa supplies a distinct course to live, function, and research study in the U (EB5 Visa For UK Citizens).S. Furthermore, the EB5 program allows capitalists to expand their assets while adding to the united state economic climate via work creation. Unlike lots of other visa groups, the EB5 visa does not require a certain company history or managerial experience, making it accessible to a bigger audience. It uses a path to citizenship after satisfying residency requirements, which boosts long-lasting safety and security and security for families.Usual Challenges and Considerations

While the EB5 visa program provides considerable chances, it additionally requires different challenges and factors to consider that possible investors have to navigate. One main issue is the substantial monetary dedication, requiring a minimum investment of $900,000 in targeted employment areas. Additionally, capitalists need to be planned for a prolonged application procedure, which can take numerous months, otherwise years. Regulative changes and the progressing landscape of migration legislations present more unpredictabilities. Capitalists must likewise consider the threats connected with the selected investment job, including possible business failures. Comprehending the ramifications of United state residency needs and the impact on family members is crucial. Comprehensive research and professional support stay crucial for an effective EB5 visa trip.Often Asked Questions

The length of time Does the EB5 Visa Process Commonly Take?

The EB5 visa process normally web takes in between 12 to 24 months - EB5 Visa. Variables affecting the timeline include application completeness, USCIS handling times, and possible delays from local facilities or extra documentation demandsCan I Include My Household in My EB5 Visa?

Yes, a candidate can include their instant household members in the EB5 visa (UK To US Investor Visa). This normally encompasses a spouse and single kids under the age of 21, permitting for family members unity during the immigration procedureWhat Happens if the Investment Stops working?

The person might lose their funding and potentially encounter difficulties in getting permanent residency if the investment stops working. It is essential to conduct detailed due persistance and think about the dangers connected with EB5 investments.Exist Any Type Of Age Limitations for EB5 Capitalists?

There are no certain age constraints for EB5 capitalists. Both minors and adults can take part, yet minors need a guardian to handle their investment. Correct lawful advice is a good idea to browse the intricacies included.Can I Operate In the united state. While My Application Is Pending?

While an EB-5 is pending, individuals can not work in the united state unless they hold a legitimate job visa. Authorization of the EB-5 gives qualification for work without extra work permissionFinanciers have to maintain or develop at least 10 full-time jobs for U.S. employees via their financial investment in a new commercial enterprise. Regional Centers concentrate on work creation indirectly, permitting capitalists to count jobs produced through financial activity boosted by their financial investments. A minimum of ten jobs must be created or preserved per financier, frequently achieved with larger, pooled investments in jobs like real estate advancements. Conversely, Direct Investment mandates that financiers directly produce at least ten full-time work within their own organizations. To qualify, an EB5 capitalist must develop or protect at the very least ten full-time jobs for U.S - EB5 Visa. workers within 2 years of their financial investment

Report this wiki page